Tax season often brings a sense of trepidation for many individuals, but armed with the proper knowledge and tools, navigating the process can become much more manageable. In this comprehensive guide filled with insights and tips to help you confidently tackle your tax obligations, we’ll delve into the intricacies of Form 1040, the standard document used to report annual income tax returns.

What is Form 1040?

The 1040 Form is the fundamental document used by individuals to report their income, claim deductions, and calculate their tax liability for the year. It serves as the cornerstone of the annual tax filing process and provides a snapshot of an individual’s financial situation.

What is Form 1040 used for?

Form 1040 is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. The form is designed to accommodate all types of income, deductions, and credits, making it applicable to a broad spectrum of taxpayers. From reporting wages and salaries to claiming tax deductions for mortgage interest or charitable contributions, the IRS 1040 Form is the primary tool to reconcile yearly tax obligations.

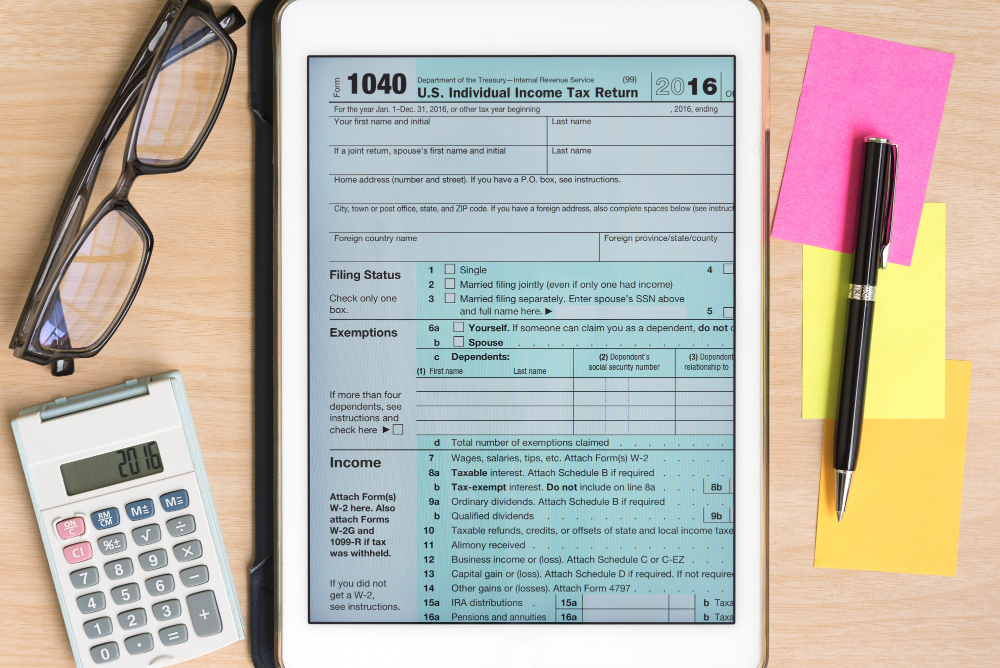

What does a Form 1040 look like?

The 1040 form is a comprehensive document that captures a taxpayer’s financial picture over the past year. It starts with personal information, then delves into income details, subtracts allowable deductions to calculate taxable income, and finally determines the amount of tax due or refund owed. Its structured format, though detailed, is designed to guide filers through their tax situation systematically.

Is Form 1040 federal or state?

Form 1040 is strictly a federal document. It’s used exclusively for filing taxes with the United States federal government, as managed by the IRS. Unlike the 1040 Form, state tax filings are handled through separate documents specific to each state’s tax authority, reflecting the decentralized nature of state taxation in the US.

Do I need to file Form 1040?

The necessity to file a 1040 Form hinges on various factors, such as your income level, filing status, and specific financial circumstances. Generally, if your income exceeds certain thresholds or you have unique tax situations such as self-employment earnings or significant investment income, filing a 1040 Form becomes imperative. It’s the vehicle through which you report your income, claim deductions and credits, and ultimately determine your tax liability or refund eligibility.

Types of Form 1040

Understanding the variations of the 1040 Form is crucial, as the IRS offers different versions tailored to specific taxpayer needs.

Form 1040-NR: For non-resident aliens earning income in the US but not residing there.

Form 1040-ES: For individuals making estimated tax payments throughout the year, like the self-employed.

Form 1040-SR: Designed for seniors 65 and older, offering a more accessible format without sacrificing detail.

Form 1040-V: A payment voucher used when submitting tax payments alongside a return, ensuring proper credit.

Form 1040-X: Essential for amending previously filed returns to correct errors or report additional income.

Where can I get Form 1040?

The 1040 Form is readily available through multiple channels. The IRS website is the primary source, offering downloadable versions to fill out digitally or in print. Additionally, physical copies can be obtained at local IRS offices, public libraries, and post offices during tax season.

How to fill out Form 1040

Filling out a Form 1040 involves a step-by-step process that begins with your personal information and progresses through income reporting, deductions, and tax computations. It’s crucial to refer to the IRS instructions for the 1040 Form, which provide detailed guidance for each line on the form, ensuring accuracy and compliance with tax laws.

Instructions for Form 1040

The IRS provides comprehensive instructions for Form 1040, which is indispensable for anyone undertaking the task of filling out the form. These instructions break down each section of the form, explaining the requirements and providing examples to help taxpayers navigate the complexities of their tax filings.

How to file Form 1040 online

The IRS encourages electronic filing (e-filing) for convenience, speed, and security. Taxpayers can use IRS-approved software to complete and submit their 1040 Form online or engage a tax professional authorized to e-file on their behalf. E-filing not only expedites the processing of returns but also reduces the risk of errors.

Form 1040 late filing penalty

Failing to file the 1040 Form by the deadline can result in penalties, which are calculated based on the amount of tax owed and the length of the delay. To avoid these penalties, taxpayers should file their returns on time or request an extension if more time is needed to prepare them accurately.

Benefit from Workhy’s tax filing services

Navigating tax complexities can be daunting, especially for non-US residents. Workhy steps in to make this process manageable, offering expert services that streamline IRS 1040 Form filing and ensure compliance hassle-free.

Beyond tax filing, Workhy provides comprehensive solutions, including company formation, EIN & ITIN applications, and bookkeeping. As your partner in success, Workhy helps unlock your full potential, ensuring a smooth and compliant financial journey. Schedule a meeting to set the foundation for your success with Workhy.