Navigating tax obligations can often feel like venturing into uncharted territory. However, with the proper knowledge and tools at your disposal, tackling tax season can become a much more manageable endeavor. In this comprehensive guide, we’ll delve into the intricacies of Form 1065, providing insights and tips to help you confidently navigate tax filing for partnerships.

What is Form 1065?

Form 1065 is a tax form for partnerships and multi-member LLCs. It helps them report their business activities, like profits, losses, and deductions, to the IRS. It’s more than just paperwork; it tells the story of a partnership’s financial status for the year.

What is Form 1065 used for?

Officially known as the US Return of Partnership Income, Form 1065 serves a pivotal role in the tax ecosystem. It’s the tool through which partnerships communicate their financial activities to the IRS. Unlike personal or corporate tax returns, Form 1065 does not directly determine tax liability. Instead, it breaks down the income, deductions, gains, and losses, which are then passed through to the partners to be reported on their individual tax returns.

Who files Form 1065?

This form is a staple for entities operating as domestic partnerships and multi-member LLCs treated as partnerships for tax purposes. It’s how these entities fulfill their IRS reporting obligations, ensuring that each partner’s share of income and loss is accurately documented for tax reporting.

Do I need to file Form 1065 if I have no income?

Yes, partnerships must file Form 1065 even if they haven’t earned income or incurred losses during the tax year. The filing goes beyond mere income reporting; it’s a declaration of operational status, expenses, and the distribution of any potential deductions or credits among partners, maintaining transparency and compliance with tax regulations.

When is Form 1065 due?

The due date for Form 1065 typically falls on the 15th day of the third month following the end of the partnership’s tax year. For most partnerships operating on a calendar year, this means the form is due by March 15th of the following year. Timeliness in filing is crucial to avoid penalties and ensure each partner has the necessary information for their individual returns.

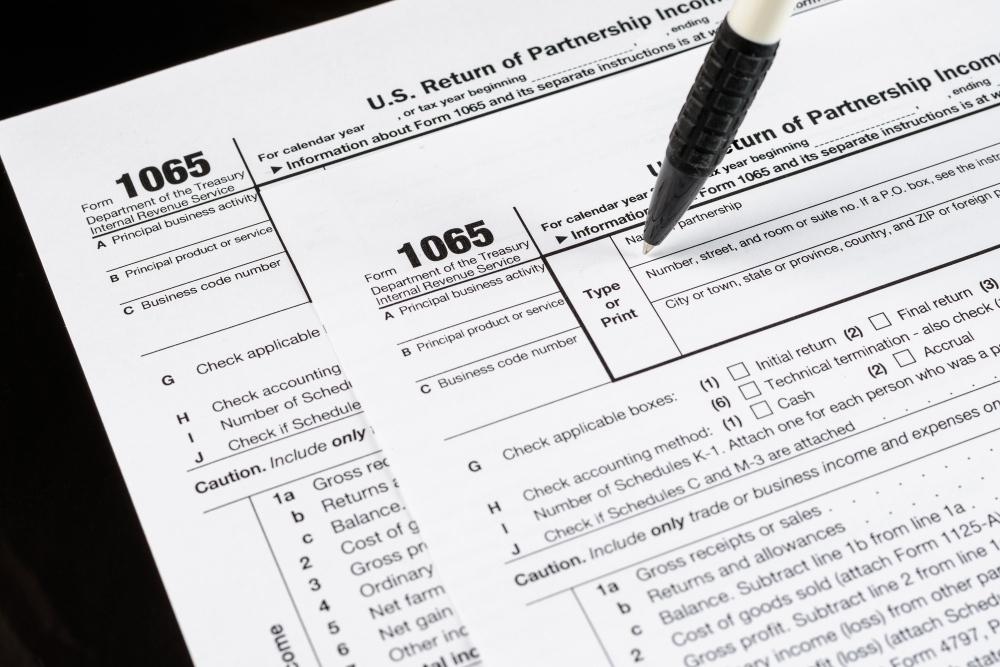

How to fill out Form 1065

Completing Form 1065 is a comprehensive process that demands attention to detail. It begins with basic information about the partnership, including names, addresses, and the Employer Identification Number (EIN). The core of the form delves into the financial essence of the partnership.

- Income: This section requires a detailed report of the partnership’s income sources, including business operations, rental properties, and investments. It’s crucial to categorize income correctly to ensure accurate tax treatment.

- Deductions: Here, partnerships itemize deductible expenses, such as salaries, rental costs, and business supplies. Documenting these expenses accurately can significantly impact the partnership’s taxable income and, consequently, each partner’s tax liability.

- Partner’s share of income, deductions, and credits: This critical part allocates the partnership’s income and deductions among its partners according to their agreement. It’s essential for maintaining transparency and ensuring that each partner reports their share of income and deductions on their individual tax returns.

Partnerships must also complete various schedules and attachments that provide further details about the partnership’s financial activities, such as Schedule K-1, which breaks down each partner’s share of the partnership’s income and deductions.

Form 1065 instructions

The IRS provides detailed instructions for Form 1065, guiding filers through each part of the form. These instructions are invaluable, clarifying what constitutes income, allowable deductions, and how to accurately report the partnership’s financial activities. Adherence to these guidelines ensures compliance and minimizes the risk of errors.

How to file Form 1065 online

Filing Form 1065 electronically is not only a convenience but a strategic advantage, ensuring accuracy and timeliness. The process involves several key steps.

- Choose an IRS-approved e-file provider: Selecting a reputable e-file service that is IRS-approved is the first step toward a successful electronic filing. These providers offer software that guides users through the filing process, ensuring all necessary information is included and accurately reported.

- Gather required information: Before starting the e-filing process, gather all necessary financial statements, partner information, and any other relevant documents. Having this information at hand streamlines the filing process.

- Complete the form using the software: The e-file software will walk you through each section, prompting you to enter the required information and helping to calculate totals where necessary.

- Review and submit: Before submission, review the form carefully to ensure all information is correct and complete. The e-file system will then securely transmit the form to the IRS, and you’ll receive a confirmation of receipt once the submission is processed.

By incorporating these detailed steps and considerations, partnerships can navigate the complexities of Form 1065 with greater confidence and precision, ensuring compliance with IRS requirements and minimizing the potential for errors.

Penalty for late filing Form 1065

Failure to file Form 1065 by the due date can result in significant penalties, calculated based on the delay’s duration and the number of partners in the entity. These penalties underscore the importance of timely filing and the need for partnerships to be diligent in their tax reporting obligations.

Simplify filing Form 1065 with the help of Workhy

Navigating Form 1065 and partnership taxes can be complex, especially for international entrepreneurs. Our expertise simplifies this process, ensuring seamless compliance with US tax laws and freeing you to focus on business growth. Workhy offer tailored services to streamline company formation, tax filing, and compliance.

From managing Form 1065 to providing comprehensive support for global entrepreneurs, including EIN & ITIN applications, bookkeeping, and more, we cover all aspects of your business journey. Schedule a meeting to take the first step towards simplified partnership taxes and business success.