For corporations navigating the maze of tax compliance, Form 1120 stands as a cornerstone document. In this blog post, we will explore its significance, explain who needs to file it and provide insights into the tax filing process for corporations.

What is Form 1120?

IRS Form 1120 is the US Corporation Income Tax Return. It’s a critical document used by corporations to report their income, deductions, credits, and tax liabilities to the Internal Revenue Service (IRS). Think of it as the corporate equivalent of the personal tax return — it provides a comprehensive snapshot of a corporation’s financial health.

What is Form 1120 used for?

Form 1120 is utilized by the IRS to calculate the income tax owed by corporations. It’s a detailed form that requires information on a corporation’s income, deductions, and credits to accurately determine the tax liability. This form is the corporate equivalent of the individual Form 1040, tailored to meet the specific reporting needs of corporate entities.

Who files Form 1120?

Form 1120 is filed by C Corporations, which are corporate entities taxed separately from their owners. This distinguishes them from S Corporations, which pass their income, losses, deductions, and credits through to their shareholders for federal tax purposes. Essentially, any corporation operating under the designation of a C Corp within the United States is required to file it annually.

Types of Form 1120

The IRS recognizes that not all corporations are the same and, as such, provides different versions of Form 1120 to cater to various corporate structures and needs.

- Form 1120-F: Specifically designed for foreign corporations to report income connected with a US business.

- Form 1120-L: Used by life insurance companies to report their income, expenses, and coverage.

- Form 1120-S: Although not strictly a variation of Form 1120, this form is used by S Corporations to report their income, deductions, and credits.

What is the due date for Form 1120?

The due date typically falls on the 15th day of the fourth month following the end of the corporation’s tax year. For corporations that align their fiscal year with the calendar year, this means that it is due by April 15th of the following year. However, corporations with a different fiscal year-end will have a corresponding adjusted due date.

How to fill out Form 1120

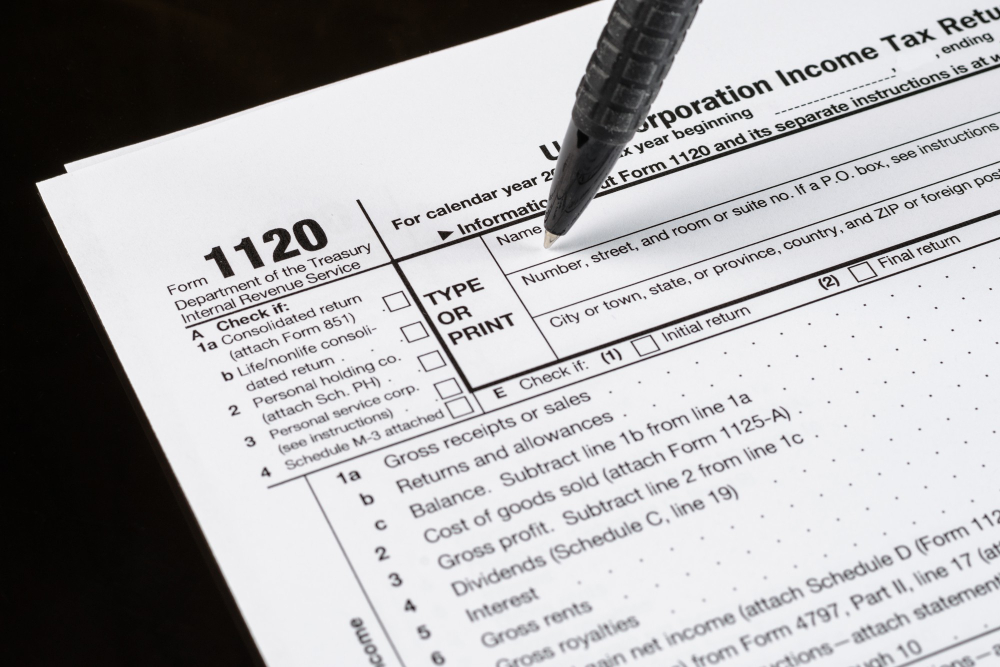

Filling out Form 1120 is a meticulous process that requires a detailed examination of the corporation’s financial activities throughout the fiscal year. To start, corporations must compile all relevant financial statements, including income statements, balance sheets, and records of deductions and credits. The form is divided into several sections, each designed to capture specific aspects of the corporate financial landscape.

- Income: This section requires a detailed account of all the income received by the corporation, including gross receipts or sales, returns and allowances, cost of goods sold, and other income streams. Accurate reporting in this section is crucial as it sets the foundation for the tax calculation.

- Deductions: Corporations are allowed to reduce their taxable income by claiming various deductions. These can include salaries and wages, repairs and maintenance, rents, taxes and licenses, interest on business debts, and depreciation. Each deduction must be substantiated with proper documentation, and only expenses directly related to the business operations are eligible.

- Tax, refunds, and payments: This part involves calculating the tax on the corporation’s taxable income, accounting for any tax credits, and determining the total tax due. Corporations can also report payments already made throughout the year, such as estimated tax payments, and apply for refunds if their total payments exceed the tax liability.

- Signatures and declarations: The form must be signed by a corporate officer authorized to do so, attesting to the accuracy of the information provided. An accountant or tax preparer who assisted with the form can also sign, indicating their involvement.

- Schedules and additional forms: Depending on the corporation’s activities and financial complexity, additional schedules and forms may need to be completed and attached. These can cover areas such as additional deductions, detailed profit or loss information, and transactions with shareholders.

By carefully addressing each section and adhering to the IRS guidelines, corporations can accurately complete this form, ensuring compliance and minimizing the risk of errors. It’s advisable for corporations, especially those with intricate financial structures, to seek professional assistance to navigate this process effectively.

Instructions for Form 1120

The IRS provides a comprehensive set of instructions for Form 1120, guiding corporations through each part of the form. These instructions offer line-by-line explanations, definitions of tax terms, and examples to assist in the accurate preparation of the tax return. It’s imperative for corporations to follow these instructions meticulously to ensure compliance and accuracy.

How to file Form 1120

Corporations have the option to file Form 1120 either electronically or on paper. The IRS encourages electronic filing due to its efficiency, accuracy, and faster processing times. Companies can use IRS-approved e-file providers or tax professionals to submit their form electronically.

Can I file Form 1120 online?

Yes, corporations can file Form 1120 online through the IRS e-file system. This method is recommended for its convenience and the immediate confirmation of receipt provided by the IRS. E-filing also facilitates quicker processing of the tax return and any subsequent refunds.

Form 1120 late filing penalty

Failing to file Form 1120 by the due date can result in significant penalties. The IRS imposes a penalty based on the tax due, calculated as a percentage per month of delay. Additionally, late payment of any tax owed also incurs penalties and interest. To avoid these penalties, corporations should ensure timely filing and payment or consider filing for an extension if more time is needed.

Workhy makes filing Form 1120 a simple process

For entrepreneurs navigating corporate taxation, Form 1120 can be a challenge, especially for those operating internationally. But fear not, our expertise is here to help. Our tailored services streamline company formation and tax filing for non-US residents, ensuring precise compliance with corporate obligations.

With Workhy‘s support, filing Form 1120 becomes effortless. We handle the complexities, freeing you to drive your business forward with confidence. Beyond tax filing, we offer a range of services to support your business needs, from EIN & ITIN applications to bookkeeping and online banking setup. Our registered agent and address services establish a strong US presence for your operations. Entrust your corporate tax filing needs to us and experience peace of mind. With our expertise, your business is in capable hands. Schedule a meeting, and let’s simplify your corporate taxation journey together.